How can a new holding own outright 5 brand new E jets without never having flown a flight and not being a subsidiary? Can you sell yourself aircraft at a huge markdown from one Holding to another without them being on the market and is that within the rules to do so?

Are you sure they were brought out right and not on credit?

No, but even on 90% credit surely with the starting 10 mil. the most you could get would be 3 170's, 5 E jets mostly 190's

You cannot sell "yourself" within two holdings, but if your alliance partner is willing to take a loss and sell you the aircraft on markdown via the market, it is possible. But there is always an inherent risk that somebody else bids on that cheap aircraft while on the market.

If you believe that a player is cheating, for any reason, then report them using the in-game support system. This forum topic will last longer than the company in question.

I have no idea if someone is cheating. I'm just curious about if there is an exploit that makes starting easier. The person in question os a trial account so i wonder if there is a way to buy a loan purchase and sell it to a second account for a small amount then bankrupt the first

If they got them off used market and if they were at 22% discount (the maximum discount I have seen on UM), bought with 90% credit

195 35,500,000 x 3 x 0.78 x 0.1 = 8,307,000

190 33,500,000 x 1 x 0.78 x 0.1 = 2,613,000

170 27,500,000 x 1 x 0.78 x 0.1 = 2,145,000

Total cash required would be 13,065,000 without seating

so given ianmanson's findings in Post #9, this would be the cash outlay:

195 35,500,000 x 3 x 0.78 x 0.05 = 4,153,500

190 33,500,000 x 1 x 0.78 x 0.05 = 1,306,500

170 27,500,000 x 1 x 0.78 x 0.05 = 1,072,500

Total cash required would be 6,532,500 without seating … totally doable.

I have no idea if someone is cheating. I'm just curious about if there is an exploit that makes starting easier. The person in question os a trial account so i wonder if there is a way to buy a loan purchase and sell it to a second account for a small amount then bankrupt the first

Only fully owned and paid aircraft can be sold at less than 100%. Aircraft that have been bought on loan and have even 1 AS$ unpaid, can be sold via market at only 100% face value.

P.S. A trial account would not have access to private listings on UM, only AS-Aircraft (system owned)

So even if somebody else listed those aircraft for them at low margin, if the buyer is on trial account he will not see them in his UM listing.

It is 100% possible.

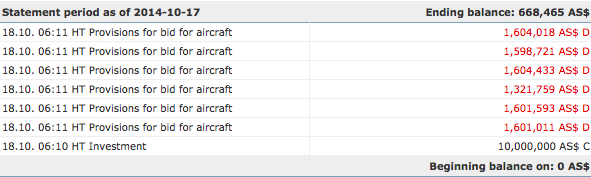

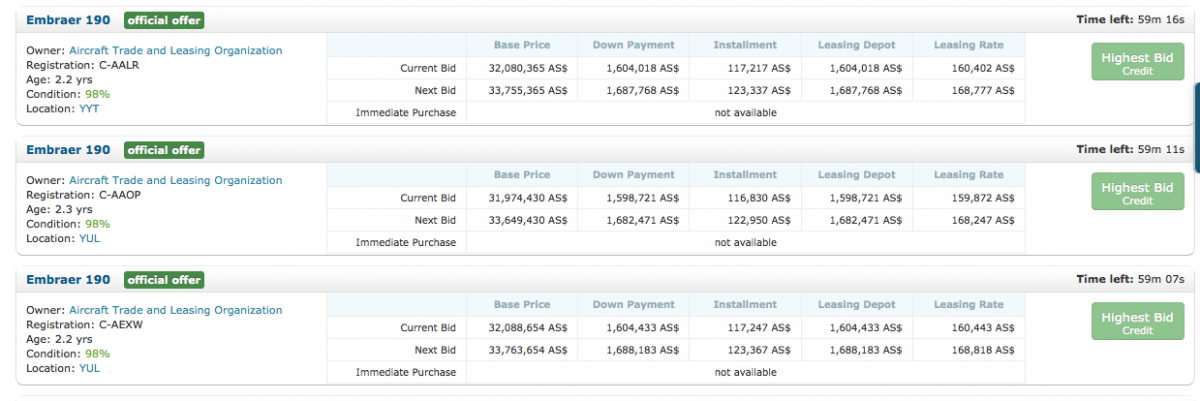

The player purchased the 5 aircraft using credit off the aircraft used market. I have just conducted an experiement with 6x E190s on another game world. As you can see from the picture I have bid using credit for 6 E190s within the 10mil...

1554

1555

I don't know why it always has to go to a cheating accusation so quickly...

Interesting, so buying o CREDIT off UM is only 5% required and 95% financed, while new purchase form factory is 10% required and 90% financed.

Does that mean though that instead of paying the leasing rate being at a steady 5% of value weekly you'd be paying 5% interest or more on the outstanding balance + the amortisation of 95% over 20 weeks? So a whole lot more to payback that unless you are running a very profitable route would be difficult to cover or are there routes that easily make that kind of margin?

Does that mean though that instead of paying the leasing rate being at a steady 5% of value weekly you'd be paying 5% interest or more on the outstanding balance + the amortisation of 95% over 20 weeks? So a whole lot more to payback that unless you are running a very profitable route would be difficult to cover or are there routes that easily make that kind of margin?

Yes, although there is some variance in the interest rate based on your credit history and general demand for loans. The interest rates quoted on the gameworld’s home page are for an AAA-rated company. A company requires a B rating or higher to qualify for a loan, but rates can vary from 10%+ on a new world with many players taking loans, to <1% on an older world with fewer players.

The loan payback schedule is the reason why most new players taking loans see their businesses fail.

thanks

Yes, although there is some variance in the interest rate based on your credit history and general demand for loans. The interest rates quoted on the gameworld's home page are for an AAA-rated company. A company requires a B rating or higher to qualify for a loan, but rates can vary from 10%+ on a new world with many players taking loans, to <1% on an older world with fewer players.

The loan payback schedule is the reason why most new players taking loans see their businesses fail.

I still don't get why and especially how it would be profitable to buy an aircraft on loan.

Let's say I buy a used 0,1 year old 737-700BGW from the AS dealer at the used market:

48.695.899 AS$ | 2.434.795 AS$ | 177.927 AS$ | 2.434.795 AS$ | 243.479 AS$

Current interest rate on ellinikon is 3,15%. Since these 3,15% count weekly and not yearly (as with rl loans) you come to a nominal interest rate of approx. 163% p.a.

Let's also assume we don't make any additional payments and go with the weekly 177.927$ for the whole length of 5 years.

So I would pay 177.927$ + 3,15% of the remaining loan weekly. At the start that is 177.927$ + 1.457.225$ = 1.635.151$ weekly! And without any special payments to reduce the loan it wouldn't turn much better over the course of the 5 years. After 2.5 years I'd still have to pay roughly 900k weekly.

How, how on gods earth, do I make that kind of money with a 737-700BGW..?

I know (or assume) the credit system only works if you pay back the loan prematurely to the schedule. But still you'd have to face these incredible payments at the start. And of course you can't pay back most of it in no time.. otherwise you wouldn't need a credit in the first place.

So, am I completely missing something? Did I calculate absolute BS? Or is it really that way? Then please explain how this is supposed to work. :blink:

So, am I completely missing something? Did I calculate absolute BS? Or is it really that way? Then please explain how this is supposed to work. :blink:

I wrote I think a fairly decent description a while back....

http://community.airlinesim.aero/topic/6702-buying-an-aircraft-off-the-market-with-credit/?p=55936

Theres a chart (which doesnt take into account used aircraft value) a bit further down as well.

Basically its an beginners mistake to buy an aircraft on credit, the guy is using a trail account so that would confirm this. As a general rule don't expect the airline to be around too long as you've already worked out ;)

Thanks

Ian

I wrote I think a fairly decent description a while back....

I checked it out, thanks!

But unfortunately it's only answering half my question. It tells me I was right with my calculation but not how anyone would make use of that model in the game.

If buying on credit is turning "cheaper" than leasing after approx. 3.5 years then the system is hopelessly broken. There is just no need for this type of funding and it's basically disabled - only "use" of it is luring new players into that trap.

I understand that it's better to lease than buy in short terms but it's ridiculous that you have to play 3.5 real time years to make this model profitable (at least compared to leasing).

Everything else in the game is sped up by the factor of using weeks rather than months but somehow this part of the game is falling behind.

So, if I'm not missing out a business model that makes this work, I tend to say the buy-on-credit system is a useless option in the game and a dangerous trap for new players.

Edit: Ok, I might have found one situation where it 'might' be useful to buy on credit. But that only works for fully grown airlines with huge income and only in special financial situations. Don't think that justifies the credit being listed as a comparable funding.

I checked it out, thanks!

But unfortunately it's only answering half my question. It tells me I was right with my calculation but not how anyone would make use of that model in the game.

If buying on credit is turning "cheaper" than leasing after approx. 3.5 years then the system is hopelessly broken. There is just no need for this type of funding and it's basically disabled - only "use" of it is luring new players into that trap.

I understand that it's better to lease than buy in short terms but it's ridiculous that you have to play 3.5 real time years to make this model profitable (at least compared to leasing).

Everything else in the game is sped up by the factor of using weeks rather than months but somehow this part of the game is falling behind.

So, if I'm not missing out a business model that makes this work, I tend to say the buy-on-credit system is a useless option in the game and a dangerous trap for new players.

Edit: Ok, I might have found one situation where it 'might' be useful to buy on credit. But that only works for fully grown airlines with huge income and only in special financial situations. Don't think that justifies the credit being listed as a comparable funding.

It all depends on the interest rate you get.

3.15% is way too high of course.

I once bought quite a bunch of 73Js on credit (90%), but at an interest rate of 0.2%. Together with the discount for a large order I ended up with initial weekly payments roundabout at leasing rates - perfectly sustainable. The average weekly charge being well below leasing rates.